marin county property tax rate

The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. Adjusted Annual Secured Property Tax Bill.

Security Check Required Selling House Home Buying Tips Real Estate Infographic

Hamilton County collects on average 153 of a propertys assessed fair market value as property tax.

. The Assessor Parcel Maps can be viewed on the Marin County Assessor-Recorder- County Clerk website. The property tax rate in the county is 078. Search Marin County property tax and assessment records by parcel number or map book number.

Penalties apply if the installments are not paid by. That is nearly double the. The measure would renew a parcel tax to support the Marin County Free Library for nine years and boost the tax from 58 per year to 98 per year increasing up to 3 annually based on the consumer.

Our talented team will do everything possible to provide a great rental experience. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes. Census blocks flood insurance rate map boundaries fire history soils planning and zoning wetlands survey and aerial imagery.

Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

You will need your eight-digit parcel number example 123-456-48 in order to view the Assessor Parcel Map page online. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. Marin county property management for quality tenants in quality homes.

Marin County Assessor 3501 Civic Center Drive Suite 208. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

You can locate your parcel number on your valuation notice tax bill deed or by calling the Marin County Assessor at 415 473-7215 or via email. Property Tax Bill Information and Due Dates. Secured property tax bills are mailed only once in October.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

Mortgage Home Loan Blogs New American Funding

Marin County Mails Property Tax Bills Seeking 1 26b

![]()

How To Sell Your Home When Your Hoa Is Involved In A Lawsuit To Read More On This Click Here Or Go To Https Loom Ly In Law Suite Homeowner Real Estate News

When Not To Compromise On A Home Infographic Home Buying Real Estate Real Estate Infographic

![]()

How To Sell Your Home When Your Hoa Is Involved In A Lawsuit To Read More On This Click Here Or Go To Https Loom Ly In Law Suite Homeowner Real Estate News

How To Check For Credibility When Buying Affordable Homes In Gurgaon Investment Property Affordable Housing Gurgaon

Marin County Mails Property Tax Bills Seeking 1 26b

The Man Who Taught The World How To Talk Like A Pirate Piraty Kurilshiki Bajkery

Upcoming Pocket Listing Jonmahoney Santabarbara Realestate Santa Barbara Real Estate Oak Hardwood Flooring Luxury Homes

San Ramon Home Buying Ripple Effect Home Ownership Selling Real Estate Real Estate Infographic

How Do I Get Zoning Passed For Tiny Houses In My Area Small Tiny House Tiny House Tiny House On Wheels

Marin County Real Estate Market Report January 2018 Trends Market News Marin County Real Estate Real Estate Marketing Real Estate

Perazzo Meadows Map By Tdlt Us Forest Service Truckee River Forest Service

How To Sell Your Home When Your Hoa Is Involved In A Lawsuit To Read More On This Click Here Or Go To Https Loom Ly In Law Suite Homeowner Real Estate News

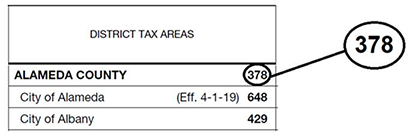

Information For Local Jurisdictions And Districts

Pros And Cons Of An Open House In Omaha Nebraska Sell My House Fast Sell My House We Buy Houses